This article analyses the anticipated lending rates for for 2024 and their correlation with European Central Bank (ECB) policies.

BRIEF HISTORY OF ECB INTEREST RATES.

In June 2014, the European Central Bank (ECB) initiated its negative interest rate policy (NIRP) by reducing the deposit facility rate to -0.1%. Subsequently, the ECB made four additional 10 basis points cuts, ultimately reaching -0.5% in September 2019.

From July 2022 to September 2023, the European Central Bank (ECB) implemented rate hikes totaling 4.5 percentage points over ten consecutive meetings. This decision was prompted by the Eurozone’s annual inflation rate consistently exceeding the ECB’s 2% target during this period.

ECB POSITIVE RATE ERA.

The European Central Bank’s move towards a more restrictive monetary policy has had a pronounced impact on bank lending, contributing to heightened challenges in terms of affordability.

In most developed European countries, we’ve witnessed in 2023 a 25% – 40% decrease in mortgage lending in 2023.

ECB OUTLOOK IN 2024 / 2025.

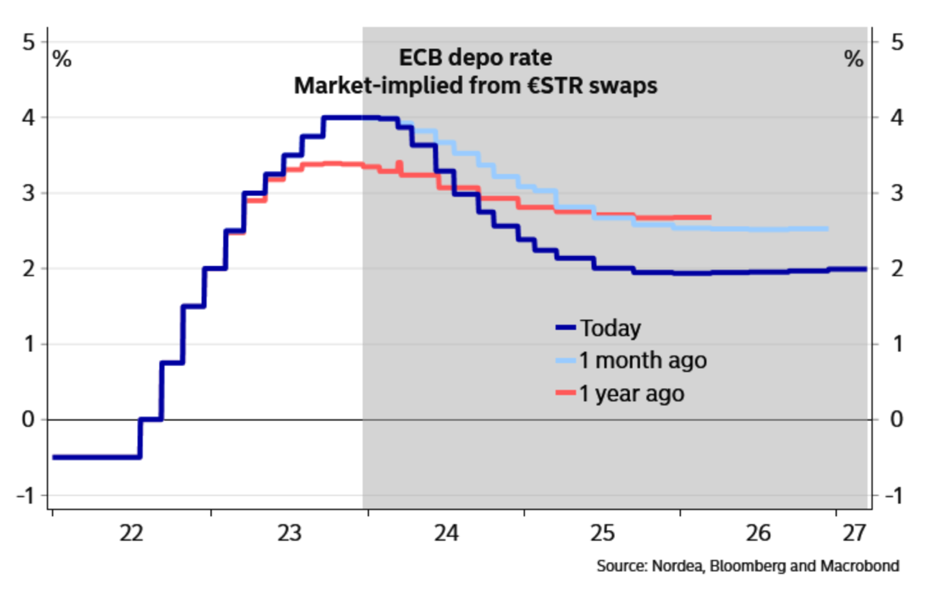

In January 2024, after experiencing a swift decline of 100 basis points in the 10-year Euro (EUR) swap rate in under two months, there is an evident possibility of encountering resistance or pushback in the near future.

The existing market pricing reflects an anticipation of rate cuts occurring at a pace faster than what central banks may currently have in mind. For rate cuts to materialize as early as March or April, key economic indicators would need to show some degree of weakening. Furthermore, a substantial decline in these figures would be requisite to justify the projection of as many as six rate cuts throughout the year 2024.

However, it is noteworthy that the totality of the 200 basis points in rate cuts priced into the market would merely position the European Central Bank’s (ECB) policy rate within the realm of what might be considered normal.

This indicates that, despite the prevailing market expectations for a more supportive approach, the overall modification would still position the policy rate within a standard range.

FORECASTED ECB INTEREST RATE DECLINE.

The European Central Bank (ECB) will only receive the December inflation data during its January 25 Governing Council meeting. Theoretically, the earliest window to contemplate rate cuts would be in March 2024, with a potential implementation in April or June. This aligns with market analyst projections and future swap rates. Such a move could positively impact mortgage activity, leading to a potential revival in property visits, infused with renewed optimism.

2024 – OPPORTUNITY FOR QUALIFIED BUYERS.

In the past year, many potential homebuyers encountered obstacles when trying to enter the housing market due to a significant rise in interest rates. As a result, there has been a noticeable decrease in property viewings, leading to a surplus of available properties. Broadly speaking, the shift in supply and demand has favored buyers but posed challenges for sellers, with many expressing regret for not having sold in 2021.

The prevailing view among property experts and wealth advisors indicates a move back to a more traditional market setting, particularly concerning secondary residences overseas, which experienced heightened demand during the COVID-19 pandemic.

There is an anticipation of a positive shift in the next 12-18 months, with expectations of interest rates decreasing. This prospect brings relief to many sellers, and it opens a window of opportunity for buyers who may be able to negotiate more favorable terms in the current market. Well-prepared borrowers can capitalize on this situation and potentially secure advantageous deals amidst the anticipated short-term drop in interest rates.